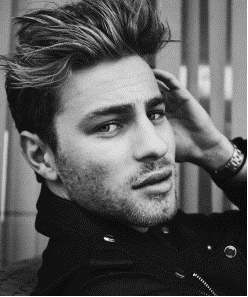

Actor, social media influencer and model Cameron Fuller is only 24, but he already seems to have a pretty good grasp on how to do Hollywood. The young star has appeared in TNT’s hit summer drama “The Last Ship,” where he played Officer Wright. He also runs his own YouTube channel that has more than 170,000 subscribers. Most recently, he co-produced the 2018 movie “Confessional,” about a murder on a college campus.

But despite the success he has enjoyed so far, Fuller knows Hollywood is a cutthroat place if you don’t know how to handle your finances. Luckily he learned, at a young age, how to resist some of the most financially destructive aspects of the Hollywood lifestyle.

But despite the success he has enjoyed so far, Fuller knows Hollywood is a cutthroat place if you don’t know how to handle your finances. Luckily he learned, at a young age, how to resist some of the most financially destructive aspects of the Hollywood lifestyle.

Making the big bet

Building a career in Hollywood is inherently risky for most people. The climb to the top is tough, and even if you get there, there’s no guarantee you’ll stay there for long. But many people do build stable careers, even if they don’t hit the jackpot.

Cameron’s father, Bradley Fuller, has made a living producing horror films. In the early 2000s, he founded the production company Platinum Dunes with a childhood friend. Throughout the next decade-and-half, he produced popular horror flicks like “A Nightmare on Elm Street” and this year’s breakout hit from John Krasinski, “A Quiet Place.”

The company has given Bradley a stable career in Hollywood, allowing him to pass on some financial lessons to his son. Namely, when you’re in the movie business, you’d best not squander your money even when you’re making a lot of it.

“The best advice I’ve gotten was to not spend more than I make. My dad taught me how to be cautious with money but still enjoy the experiences it can provide you. Don’t make the big bet unless you are comfortable losing the bet itself,” said Cameron.

Don’t make the big bet unless you are comfortable losing the bet itself.

Large sums, big savings

Cameron will be the first to tell you that money can come fast in Hollywood. Those not mature enough to handle monetary success can run into major financial problems. Because of the way society has taught us to view money, most people see major cash windfalls as a license to make massive purchases.

“If you didn’t have a lot, and then you suddenly do, most people would spend it to upgrade their lives at that given time,” Cameron said.

But the young actor’s idea of Living Within Your Means isn’t about going out and spending money just because you have it. His approach is about looking at the big picture and thinking of how you can provide for yourself (and the people you love) over the long-term.

He acknowledges that houses, cars, trips and expensive meals can quickly become the norm. At the same time, however, he knows that not everyone in Hollywood can live this way.

“As an actor, when work is good, it’s GREAT. But when you hit a cold streak, you need to have enough money to live through it. That is why it’s important to save when you’re at your peak, because most people have a hard time sustaining that for their entire lives. Instead of having the coolest car, invest your money in stocks and bonds, and put a certain amount of every dollar you make into your retirement account,” Cameron said.

As an actor, when work is good, it’s GREAT. But when you hit a cold streak, you need to have enough money to live through it.

Saving for a Fuller future

At the end of the day, money is meant to be enjoyed. Because we all have different values and enjoy life in our own way, Cameron believes that Financial Freedom is different for every individual.

Of course, the Financially Free life should always strike a balance between enjoying your money in the present and putting some aside for your future self. And while everyone wants to dine at fancy restaurants and buy expensive clothes, Cameron has learned first-hand that there is a lot of reward in saving, too.

“The smartest move I have ever made was investing in stocks. Instead of letting my money sit in my bank account, I researched stocks and put money into them. Years later, I am seeing the benefits of that, and I am so glad that my younger self made the right choice,” Cameron said.

The wisdom to take care of yourself in the present, while also planning for the future, isn’t always present in young actors. It’s hardly common in most “normal” people, either. But this Pay Yourself First mentality has already brought Cameron plenty of benefits at the ripe age of 24.

Even outside of Hollywood, many people want to live a Hollywood lifestyle. We really need to assess the reality of this desire.

Follow Cameron on Instagram here!

The views and opinions expressed are those of the guest author and do not necessarily reflect the views and opinions of MindShift.money.

image credit: Bigstock/kathclick