At some point, everyone’s indulged in fantasies of what they would do with the wealth of their favorite celebrity. There are whole TV shows and websites dedicated to showing us the net worth of Hollywood stars and their glamorous lives.

But it’s a common misconception that the rich and famous (whatever that means) never have to worry about money. The myth of fame and fortune as a cure to money woes is a toxic one. Because reality is that if you suddenly come into a windfall, you aren’t automatically Financially Free.

That means even high-net-worth celebrities are bound by the very same principles you learn in Financially Fit Bootcamp.. If they’re not Financially Fit, they suffer the same Money Stress as everyone else.

Let’s take a fresh look at the building blocks for Financial Freedom and what happens when even wealthy celebrities don’t follow them.

Live Within Your Means

There’s a reason Live Within Your Means comes right after Pay Yourself First in the personal finance Success Pathway. Because Living Within Your Means is crucial no matter how much money you make. Don’t believe me? Even celebrities earning tens of millions of dollars a year can lose everything if they don’t adhere to this principle.

In 2017, Johnny Depp, who has an estimated net worth of $400 million, declared bankruptcy. He also filed a lawsuit against his managers for allegedly mismanaging his finances. Celebrities are certainly targets for fraudsters, so his story was believable. But in this case, court documents revealed Depp was living a lavish lifestyle that consistently cost at least $2 million per month to maintain. He routinely made outlandish purchases, like spending $30,000 per month on wine or buying a $3 million cannon to launch the ashes of Hunter S. Thompson across the desert. There’s nothing wrong with these choices if they aren’t outside your means. For Johnny, though, that wasn’t his situation.

Nicholas Cage is also well-known for his crazy expenditures. Over the years, the top-earning Hollywood actor frittered away an estimated $150 million fortune on several castles (do you really need more than one?), shrunken pygmy heads, a pet octopus and a real dinosaur skull. Not to mention yachts, sports cars and multi-million dollar homes. He was slapped with a $6.2 million tax lien in 2009 and has been taking seemingly every film role offered to him since to pay off his debts.

M.C. Hammer’s entourage, enormous mansions and other extravagant purchases caused him to file for chapter 11 bankruptcy in 1996. “My priorities were out of order,” he said in an interview with Ebony magazine.

On the flip side is Jay Leno. In spite of an average $15 million annual salary from The Tonight Show, he chose to live under his means. Early on, he vowed to never spend any of his network money. He lived a comparably frugal life on his six figure income from stand-up comedy alone. This allowed him to amass an estimated net worth of $350 million.

Protect Yourself And Build A Security Buffer

For celebrities who do Live Within Their Means, lot’s (and lot’s) of unexpected expenses are likely to come up. Especially in the form of lawsuits.

That’s why Protecting Yourself and a Security Buffer are so important.

To cover his growing legal fees, Bill Cosby has sold tens of millions of dollars of his Los Angeles real estate portfolio, including a downtown Santa Monica building worth $20 million.

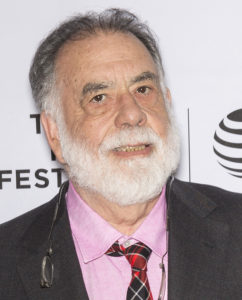

Legendary film director and uncle to the above-mentioned Nicholas Cage, Francis Ford Coppola has filed for bankruptcy no less than three times in one decade directly stemming from financial issues that came with his film, One From the Heart. Earning $4 million in box office on a $27 million budget, the film was an undeniable flop and financial failure. But compared to the amount of debt he generated as a result, it’s nothing. According to the Los Angeles Times, the release of the film triggered a “series of complicated financial transactions.” Coppola ended up owing his partner and co-producer Fred Roos $71 million. It took ten years and three separate bankruptcy filings for him to become solvent again.

In 1993, Kim Basinger had to file for bankruptcy protection after backing out of a contract to appear in the film Boxing Helena. She was ordered to pay the production company $8.1 million.

Make Your Money Work For You

Celebrities (and everyone) can be forgiven for mistakes on this step of the path to Financial Freedom. Because the process of building an investment portfolio that consistently generates Cash Flow will never go perfectly.

You need to do your homework before haphazardly investing in property and stocks. And, of course, always be wary of who and what you’re investing in. Celebrities Steven Spielberg, Kevin Bacon & Kyra Sedgwick, Leonardo DiCaprio, Ben Affleck, Cameron Diaz, Ben Stiller, Wesley Snipes, Sylvester Stallone, Al Pacino, Martin Scorsese have all been the victim of investment fraud.

In the bad choices category, we have part of Johnny Depp’s financial downfall. Along with his extravagant personal expenditures, there’s the $4 million he invested in a failed record label.

Kim Basinger, also didn’t have an adequate Security Buffer. She partnered with a team of investors to purchase most of the land in Braselton, Georgia to develop a movie studio and film festival site. Plans proved flawed, however, and the group was eventually forced to sell off the land at a loss.

For all the toxic, reality-skewing fodder celebrity tabloids put out, one thing they say rings truer than we might think. The stars really are just like us. And that means they have to be financially literate.

Financial Freedom is more than numbers in a bank account—it’s a state of mind and a system of healthy habits.

The views and opinions expressed are those of the guest author and do not necessarily reflect the views and opinions of MindShift.money.

image credit: Bigstock/Fer Gregory