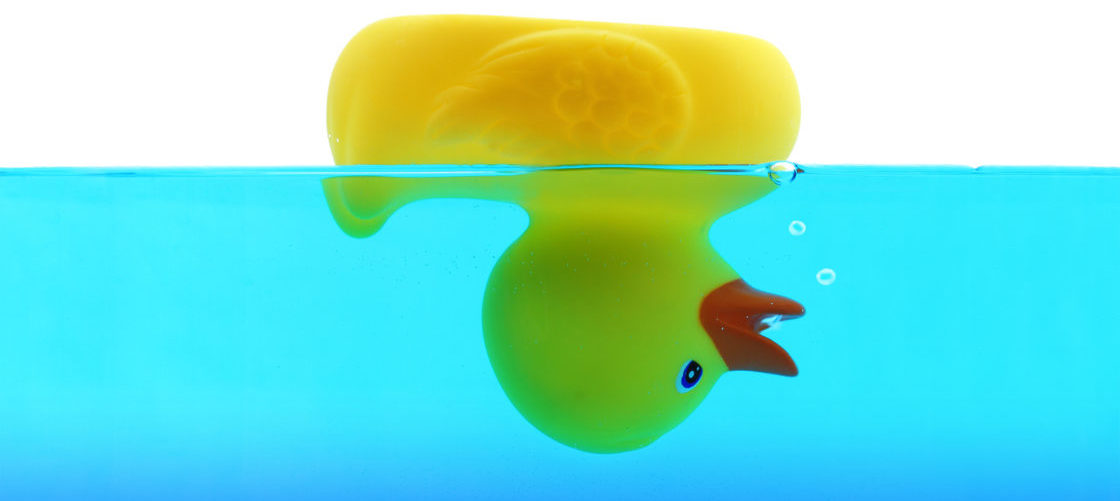

The sunk cost fallacy — it’s why you continue to pursue something you know is a bad idea simply because you’ve already invested money, time or effort. And succumbing to sunk costs instead of moving on is a major obstacle to your financial health.

So today I’m looking at how the sunk cost fallacy creeps into your thinking about money. And I’m sharing ways to identify and sidestep the lure of this fallacy as you move toward Financial Freedom.

The “sunk cost” fallacy defined

According to Encyclopedia Britannica, a sunk cost is an economic and financial term referring to “a cost that has been incurred and cannot recovered.” In the world of business, the cost is usually counted in dollars. But sunk costs can just as easily be something else of value. From something minor like available counterspace all the way through to big stuff like your energy, sanity and time.

So where’s the fallacy? In that instinctual nagging we all have to throw more — money, time or energy — into something we know is bad news. After all, abandoning ship when things start to go south feels as though you’re throwing away what you already invested.

So where’s the fallacy? In that instinctual nagging we all have to throw more — money, time or energy — into something we know is bad news. After all, abandoning ship when things start to go south feels as though you’re throwing away what you already invested.

Here’s an everyday example: Your relationship is deeply important to you, but you realize it’s irreparably toxic. If you stay with a toxic person purely because of the sacrifices you’ve made — the years you’ve spent together, immeasurable energy and plenty of love — you’ve fallen victim to the sunk cost fallacy.

Avoiding that fallacy means recognizing you simply can’t recoup that time, energy and love. So you can stick around and waste more of your resources, or you can choose to dedicate your remaining resources to someone or something else.

Encyclopedia Britannica adds this: “The reason economic analysis ignores sunk costs is that doing so helps to prevent decision makers from throwing good money after bad when they are stuck in an unprofitable project. It is often the case that heavy initial investment in a poor project results in a temptation to spend more money on the project in the hope of recovering the sunk cost or preventing embarrassment. Economic theory tries to solve that problem by focusing only on future costs and returns.”

Scenario 1: Your investment is a loser

Sure, you’ll undoubtedly face dips in the market as you build your portfolio. But your problem isn’t a dip. The investment you chose is locked in a tailspin. Maybe you chose a high-risk stock you hoped would pay out big . . . but it’s quickly and most assuredly plummeting right to zero.

The Temptation: Pray with all your might a stock market miracle will happen, and that your stock will not only rebound, but pay you 10 times over.

How to Deal with Your Sunk Cost: If your stock is in a full-fledged nose-dive with minimal hope for recovery, the time to get out has arrived. Accept you’re going to take a loss. The only question now is how big a loss you’re going to take. Waiting until the bitter end could cost you every penny. So sell while you can still recoup some of your money. (To ease the blow, consider that you may get a break on your tax return for the beating you took in the market.)

Scenario 2: You’ve got a whopper of a shopping hangover

You were feeling down (or bored or exhilarated or anything!) and bought yourself some pricey retail therapy. You definitely couldn’t afford that designer dress or shiny gadget. But you swiped your card and made a purchase that’s completely nonrefundable.

The Temptation: You’re already in the hole, so why not get the shoes and purse to match! Or pick up some sweet accessories to go with your new tech toy.

How to Deal with Your Sunk Cost: Face your buyer’s remorse head-on. Use the opportunity to figure out how you can prevent yourself from overspending in the future. And plan a strategy for dealing with the debt and getting yourself back on track. And you may be able to make some of your money back by reselling the purchase or getting a tax break for donating to charity.

Scenario 3: Your Financial Advisor’s a dud

You didn’t ask the right questions when you hired your financial advisor. Or she refuses to work with the goals and choices you have today. You’re getting nothing of value from your money pro. But you are continuing to shell out for her fees year after year.

You didn’t ask the right questions when you hired your financial advisor. Or she refuses to work with the goals and choices you have today. You’re getting nothing of value from your money pro. But you are continuing to shell out for her fees year after year.

The Temptation: You’ve been working with your advisor forever, and you can’t throw that away. Sure, you’re not getting anything out of the relationship anymore. But starting over on your own or with a new professional sounds so unfair.

How to Deal with Your Sunk Cost: All those hours spent in advisory sessions and dollars spent on professional fees are gone. But you still have a financial future to build! Don’t throw more time and money into a partnership that isn’t going to get you where you want to be. Instead, find a new, amazing pro to add to your personal finance team! The financial rewards and the joy of working with someone who gets you are infinite.

image credit: Bigstock/viperagp

Dr. Tony is the co-founder of MindShift.money and the best-selling author of three books on personal and business finances. Having achieved Financial Freedom at 27, Dr. Tony believes that through Financially Fit Bootcamp and Cash Flow Cure everyone can get there. He has made it his life’s mission to help others live a life where their money works for them—not the other way around.