This is the fifth part of our six-part intensive series on the Freedom Generator. If you missed the first article, you can read it here.

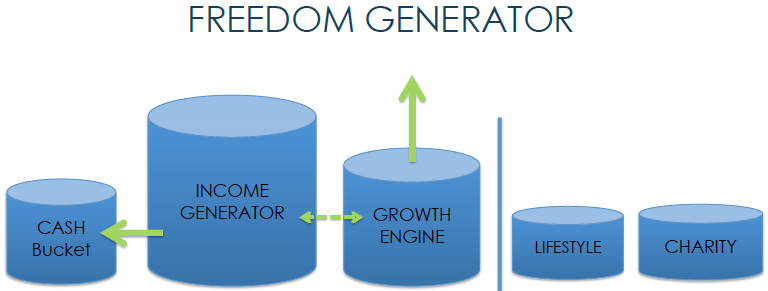

It’s time to head to the other side. So far, in our deep dive into the Freedom Generator, we’ve focused entirely on the left-hand side of this critical money machine.

We’ve seen how the Cash Bucket protects your family in the event of financial disaster. We’ve looked at how your Income Generator is built to power your Freedom lifestyle. And we’ve examined how the Growth Engine amps up the resources you’ll have in your golden years.

Today’s we’re peering around the wall to the right-hand side of your Freedom Generator. Let’s examine the essential role of the Lifestyle Assets Bucket . . . and how overfeeding it derails many people’s journeys to Freedom.

What’s In The Lifestyle Assets Bucket?

[memb_is_logged_in]

Your Lifestyle Assets include all of the physical items that you buy and use in order to support your current lifestyle. They’re the things you need and the things you have in order to enjoy your life. These possessions include both big-ticket and everyday items:

- Your house;

- Your car:

- Your jewelry, art and valuables;

- Your household goods; and

- Everything else you own.

Keep in mind there’s a fundamental distinction between Lifestyle Assets and Working Assets. Working Assets, called investments, aren’t just things you possess. They actually make you money. And they come in the forms of cash assets, income assets and growth assets.

Lifestyle Assets, however, don’t give you cash flow. In fact, they usually pull money out of your pocket—sometimes in the form of debt and sometimes in upkeep costs. For instance, your house may bring with it a mortgage, property taxes, insurance premiums and home maintenance costs.

The end results is that—while you need to have certain Lifestyle Assets—this bucket doesn’t further your journey to Financial Freedom. In fact, for many people, it’s an impediment to Freedom that manifests as overspending and debt.

Setting Up Your Lifestyle Assets Bucket For Freedom

The secret to striking the balance between your Lifestyle Assets Bucket and the buckets that contain your Working Assets is simple: Live Within Your Means.

When you buy a Lifestyle Asset, you’re effectively choosing to allocate your funds to stuff. And that means you’re not putting that money toward the cash-producing investments in your forms of Cash Bucket, your Income Generator and your Growth Engine.

So keeping your Lifestyle Assets Bucket from overflowing—at the expense of your Working Assets—means minimizing and eventually eliminating your debt.

Assets vs. Liabilities

When you do choose to make a purchase for your Lifestyle Assets Bucket, your aim is to acquire assets—not loans! You want a house . . . not a mortgage. A car . . . not a car loan. An education . . . not staggering student loan debt.

I like to say there’s only one good kind of interest. That’s the kind you receive, not the kind you pay! Whenever possible, avoid borrowing money that requires you to repay not only the principal but also significant interest costs. Instead, channel those funds into Working Assets that pay you in interest and dividends effectively accelerating your journey to Freedom.

Of course, there are circumstances in which it makes absolute financial sense to take on debt. A mortgage or a student loan—while costly in terms of interest—may be smarter solutions for you than renting a home or having your earning power capped by your lack of education.

Before you agree to debt on any asset, always put a viable plan in place for repayment. And, if you work with a financial advisor, crunch some numbers with him or her. Ensure that the cost of your debt will, in the long run, help you achieve Financial Freedom that much faster.

Community Question: Are you overfeeding your Lifestyle Assets Bucket at the expense of your Working Assets? What’s your best tip for finding a balance that fuels your Freedom? Share with us in the comments below!

image credit: Bigstock/ leaf

[else_memb_is_logged_in]

[memb_include_partial id=338]

[/memb_is_logged_in]

Dr. Tony is the co-founder of MindShift.money and the best-selling author of three books on personal and business finances. Having achieved Financial Freedom at 27, Dr. Tony believes that through Financially Fit Bootcamp and Cash Flow Cure everyone can get there. He has made it his life’s mission to help others live a life where their money works for them—not the other way around.