In Financially Fit Bootcamp, you can move toward Financial Freedom at your own pace. You make the decisions around your lifestyle, how quickly you want to reach Financial Freedom and how you’ll get there. But if your goal is to get there as quickly as possible (which is what we hear from most people!), there are changes to your personal lifestyle and financial habits that will help you accelerate your Financial Freedom.

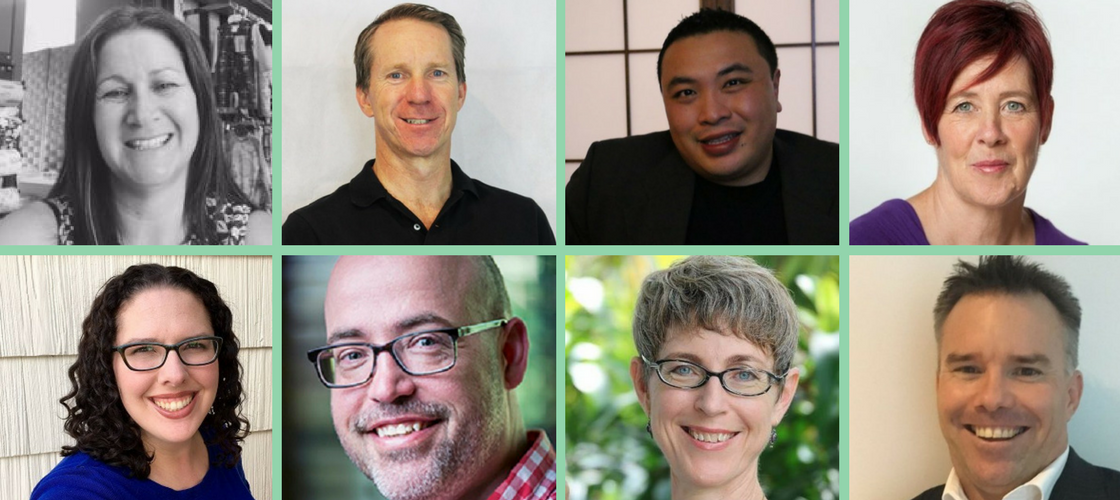

We wanted to hear how real people make those changes and accelerate. So today our Financially Fit Bootcamp coaches are answering the question, “How are you accelerating your own personal Financial Freedom journey?”

Continue To Pay Yourself First

“I add small amounts as often as possible to my Pay Yourself First fund. Even a 1 percent growth in interest from the bank is better in my pocket than theirs.”

Melinda Smylie, Founder, Wear Kids Play

Dump Debt

“At this stage, I’m using a lot of my monthly surplus to set up and support the growth of my business. I previously had money going into investments (my [Freedom] Generator). However, now that I’ve completed the [Financially Fit Bootcamp] program, I’m diverting this money to eliminating debt. There have been some small debts that I’ve been ‘maintaining’ rather than reducing. So this is the new priority: get rid of them before putting surplus into investments. I’m confident this will be a more effective way to achieve Financial Freedom in a shorter timeframe than the previous way I had been managing my money. The great thing is I have assets generating Cash Flow and growth and can pause for a short time to clear the small debts and then accelerate the [Freedom] Generator.”

“At this stage, I’m using a lot of my monthly surplus to set up and support the growth of my business. I previously had money going into investments (my [Freedom] Generator). However, now that I’ve completed the [Financially Fit Bootcamp] program, I’m diverting this money to eliminating debt. There have been some small debts that I’ve been ‘maintaining’ rather than reducing. So this is the new priority: get rid of them before putting surplus into investments. I’m confident this will be a more effective way to achieve Financial Freedom in a shorter timeframe than the previous way I had been managing my money. The great thing is I have assets generating Cash Flow and growth and can pause for a short time to clear the small debts and then accelerate the [Freedom] Generator.”

Andrew Woodward, Founder, The Investor’s Way

“By paying all my debts off and having no more debts. I can channel the money that was paying off the debts into accelerating my Freedom Generator. This includes selling my house.”

Michael Tandean, Founder, Money Knowledge

“I absolutely do something to accelerate my path to Freedom. At this stage, it’s by terminating the past debt I’ve accumulated. Each debt I pay down is one closer to Freedom. I started with four back in September 2016, and I only have one to go. I will be debt free April 2018. If I paid the debt like I had or I hadn’t in the past I would have been paying it for another four+ years or more. Which is quite likely as I would have added more to it instead of now having all of that money freed up to drive me ‘north to freedom like a homesick angel’ as Dr. Tony says. I love that saying so much I’ve adopted it as mine too.”

Susan Whelan, Founder, FeelAliveInside.com

Leverage Your Business

“I’ve added financial coaching to my toolbox to accelerate me to Freedom. It’s just getting started, but I have every confidence it will continue to grow.”

Wendy Priester, Owner, D&L Financial Coaching

“I have my own business that I’m using to accelerate my path to Freedom. I have a residual income from the retail energy sector and continue to build this. It’s currently providing eight percent of my Financial Freedom number. In addition, I’m adding financial coaching to my arsenal.”

Larry Malone, Founder, LarryDMalone.com and FinancialTitan.com

“I am currently restructuring my business and working through the Cash Flow Cure program to really bring out the true potential of my business as an accelerator towards personal Financial Freedom. At this point, I can see the potential.”

Linda Emslie, Transformation and Wellbeing Specialist, Lovlali

“I would like to think that being self-employed is going to assist me to accelerate my path to Freedom as I’m not constrained by a normal PAYG amount. But it can also sometimes work in reverse as your income can fluctuate. Even though life has thrown a few curve balls at me, I still do feel that it’s the better solution longer term, and it will be effective in getting me to Freedom quicker and help to create multiple income streams for me.”

Chris Lee, Wealth Advisor, Wealth Today LTD.

So there you have it! From eliminating debt to starting their own businesses, our Financially Fit Bootcamp coaches are moving quickly along the path to Financial Freedom!

Some answers have been edited for length and clarity.

The views and opinions expressed are those of the guest author and do not necessarily reflect the views and opinions of MindShift.money.